(1) Trends that will shape the future of filtration

Pure water and clean air … It’s a simple desire by people in every part of the world, but one that’s sometimes difficult to obtain. Utilizing nonwoven filtration media can help solve daunting purification challenges and help create a healthier, safer and cleaner environment.

Filtration has become so important that it can be found almost everywhere. Nonwoven materials in the global filtration market continue to enjoy steady growth and are expected to reach 747,000 million tons by the end of 2020, according to INDA’s Worldwide Outlook for the Nonwovens Industry report.

As developing regions rapidly urbanize, filtration systems will continue to be needed along with the construction of water, power, communication and transportation systems. More vehicles on the roads also will contribute to the growth. I see the most growth and new potential in Latin America, Africa and Southeast Asia.

Environmental concerns leading to more stringent regulation for clean air and water are creating market opportunities for filtration technologies around the globe.

• Emissions: One of the biggest factors contributing to filtration growth is

automotive emission regulations being implemented globally to reduce the discharge of carbon dioxide (CO2), sulfur oxides (SOx), nitrogen oxides (NOx) and particulate matter into the environment. Europe’s emissions standard, Euro 6, aims to reduce levels of harmful car and van exhaust emissions in mass-produced petroleum and diesel cars. Both India and China are implementing their own stringent rules based on European regulations. New laws going into effect in 2020 and beyond are expected to bring a much-needed change in air quality. However, the trend toward electric vehicles in China and India could negatively impact the emission filtration market in the future.

• Marine: The marine industry also is implementing new rules to significantly

reduce the sulfur content of the fuel oil used by ships. Effective Jan. 1, 2020, the International Maritime Organization (IMO) will enforce a new 0.5 percent global sulfur cap on fuel content from the present 3.5 percent in response to heightening environmental concerns, contributed in part by harmful emissions from ships.

• Pharmaceutical: In the pharmaceutical industry, USP 797 in the U.S. provides

standards to prevent harm to patients resulting from contaminated or improperly made compounded sterile preparations (CSPs). The regulations include regular particle monitoring and measurements to ensure sites with the most potential risk meet air cleanliness levels.

• Carbon Neutrality: While the United Nation’s Paris Agreement is very broadly

defined in terms of decreasing emissions, companies are responding with efforts to either remove CO2 from the air or reduce their CO2 output because of strong consumer pressure for carbon neutrality.

• Clean Energy:Another aspect is the desire for cleaner energy. Natural gas and

shale gas are booming and filtration and separation is used upstream in the process to get rid of particulate matter, oil condensates and other impurities.

A key difference between the U.S. and Europe is the debate over the use of electrostatic charge on filtration products to provide higher efficiency. Electrostatic charge is being embraced in Asia and other parts of the world because of the performance it provides. Electrostatic air filters work similarly to a magnet. Formulated fibers generate strong static charges when air passes through them attracting airborne particles and holding them until the filter is cleaned.

The innovative technologies in the filtration industry are as follows::

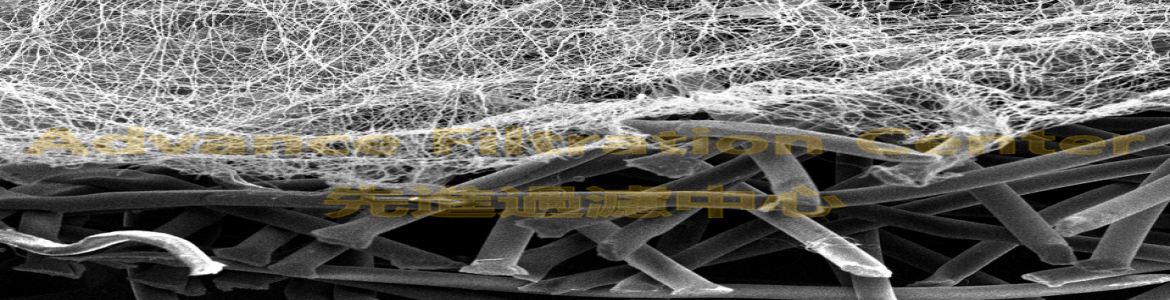

• Nanofibers: Nanotechnology is likely the biggest emerging technology that will

continue to impact the filtration industry, according to our panel of experts. Nanofibers can be used to drive down scale and to enhance filtration selectivity. By modifying membranes and using hollow fiber membranes, gas molecules can selectively be filtered out of a process, resulting in higher purity.In the last five years, the use of nanofibers in filters in the U.S., Japan and China has increased, and anticipates more research interest and commercial products will come into the market in the near future.

• Reverse Osmosis: Reverse osmosis has become the key filtration process in

desalination, industrial process waters, municipal and industrial wastewater reuse, and point-of-use and point-of-entry devices.Controlling biological growth inside reverse osmosis modules remains a key challenge to make the process more cost effective and robust. Putting silver or another nanoparticle on the surface of the filter can reduce its affinity to microorganisms, controlling biofouling and extending filter life.

• Recyclable Filters:Over 99 percent of filters are discarded without recycling or

reuse, creating an environmental burden, Feng says. While the issue hasn’t gotten a lot of attention, he predicts this will be important in the years to come.

• Microfluidics:We can harness the power of nanotechnology and microfluidics to

make a new generation of filters that will have better performance. It is seeing microfluidics filters that can be designed with 3-D printers being sold by start-ups that have interesting potential.

• Hybrid Filtration Systems: Combine a nonwoven with an absorbent or inorganic

material like activated carbon. The nonwoven filters out the large particulate matter, while the absorbent embedded into the structure removes chemical impurities, resulting in a cleaner end product.

• Selective Filtration:Surface modifications of filters which is prevalent in

pharmaceuticals can be implemented into a lot of different sectors. By including a charge imbalance or functional group onto a filter, specific components can be selectively filtered out. This could potentially be used to capture CO2 from flue gas or air, creating a cleaner environment.

• Smart Filters: Partnerships between filtration and water companies also could

result in more intelligent filters with sensors that can capture data on usage and help run plants. Smart filters with sensors also can be used to measure biological activity and growth and minimize the problems of biofouling in water. With the Internet of Things (IoT), self-operating wastewater plants with smart filters that provide diagnostics could be the wave of the future in developing countries.

Source: Filtration News, August 2019.

(2) Global consumption expected to reach $64.8 billion by 2024

In 2019 hundreds of nonwoven products are in use globally. Such a diversity leads to equally diverse supply chains, competitive environments, drivers, trends and regulatory issues.

Smithers Pira’s latest market report, ‘The Future of Global Nonwoven Markets to 2024,’ forecasts the global consumption of nonwovens to grow from a projected $46.8 billion in 2019 at an annual rate of 6.7% during 2019-2024 to reach $64.8 billion in 2024. This reflects confidence that relatively short-term issues like the China–U.S. trade war, Brexit uncertainty, and other global issues affecting economic growth will be resolved (or at least accounted for) and nonwovens will grow at increased rates, especially after 2021.

With shifts in end-use demands increasing across the five years to 2024, ‘The Future of Global Nonwoven Markets to 2024’ identifies the following key drivers and trends for the global nonwovens industry today:

w Sustainability – Accelerating demand for sustainability is expected to show to 2024. The growing move to ban plastics in many products strongly favors the use of sustainable nonwovens.

w Regulatory issues – The approval by the EU of its directive on single use plastics, specifically hygiene products and wipes, indicates that the continued movement away from plastics will be a major driver within nonwovens.

w Costs (energy/water/raw materials) – A major driver for the growth of nonwovens is their lower cost compared to alternatives. A cost is measured not only in dollars or euros, but also in the consumption of scarce resources, given that water and other raw materials are all under pressure.

w User requirements – Nonwoven materials can deliver performance properties unattainable (economically) by other materials; sometimes pure performance rather than cost or convenience drives this market.

w Retail trends (private label versus brands) – Globally, private label, nonwoven products are gradually increasing market share versus branded products, although this varies widely by region and end-use.